FIRST STEPS

CONTEXT

Context Overview

Bitcoin is digital scarcity, a breakthrough discovery occurring at a key moment in History. We have entered a critical juncture. What can we say about it?

This idea of the end of History, of all nations converging towards a peaceful global government... Well, let us just admit that we were wrong and that we are not quite out of the woods yet...

In this context, it makes sense to examine theories, which describe the cyclical march of the world. Popular amongst bitcoiners such theories have accurately predicted key trends and deserve our attention.

What does History teach us about the role of the state when it comes to the management of money? Does the monopoly last forever?

It's not the End of History

This "End of History" is an idea that has permeated Western culture for over thirty years. Educational programs, expert analyses and political speeches have lulled us into the illusion of a concert of nations converging - in unison or almost, but in any case inevitably - towards the same ideal of society. For several decades now, the peoples of many Western nations, thus mystified, have been carelessly moving towards a globalized, rich and peaceful world, ceding their political, economic, energy, cultural and military sovereignty without much resistance.

The almost instantaneous propagation of these multiple crises on a planetary scale has highlighted the vulnerabilities of the system, underlining the fragility of the key international relations that guaranteed the cohesion of the whole. The ingenuity of the vision of a world out of history has been exposed. This myth has been shattered. We have never left History. Our societies are not yet immune to the vectors that have recurrently pushed them to profound questioning, sometimes precipitating their collapse.

The realization that we are not out of the woods yet is the tipping point from which, out of necessity, we have to re-explore the recurring patterns of history and the theories describing the cyclical march of the world.

Cycles predicted it!

Let us check a few theories and approaches that describe economic, socio-cultural, and political cycles. They offer new and convincing perspectives on our current context. Given their outstanding predictive power over the past decades they deserve all our attention.

The end of a debt cycle

In The Changing World Order (2022), renowned billionaire and financial analyst Ray Dalio examines major economic and political cycles. He describes COVID as the trigger for a global economic recession on a scale larger than anything we have seen in the past 80 years, pointing out that this crisis was largely predictable, given the final stage of a long debt cycle we are in.

When debt cycles break, central banks devalue currencies by printing new money, which disrupts the entire economy, precipitating the collapse of reserve currencies and the emergence of a new monetary and financial order. The level of debt is such that a reset of the monetary system is now inevitable. But what shall we do with the debt? A prolonged austerity cure? Boost global growth? Cancel the debt? Devalue it? Raise taxes?

A major crisis precedes a new order

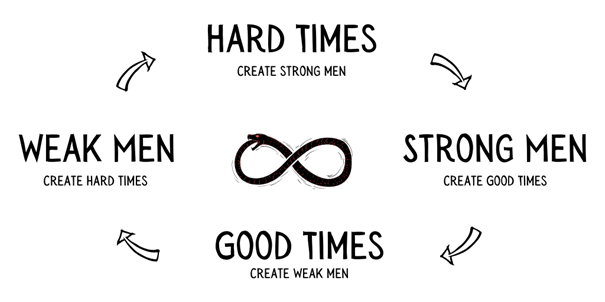

The Fourth Turning (1997) is another important book which deals with history, political science, sociology, demography and philosophy. Its authors claim that history unfolds in generational cycles of 80-100 years, with four “turnings”.

We can expect to see individualism and collectivism clash again, no longer for the control of the means of production but this time on the cultural terrain.

Such impulses of totalitarism are already manifest in geographies where they were thought to be extinguished forever. Bitcoin will undoubtedly be one of the main drivers of the coming renaissance.

How the turnings unfolds:

The High marks the beginning of a cycle. It is the post-crisis phase or “season” where optimism prevails amongst the population. It is accompanied by a high degree of conformism and trust in the institutions. The latest High started at the end of the second world war.

Twenty years after the beginning of the High, awakenings begin. They are typically periods of spiritual upheaval in reaction to a challenged value system. A sense of rebellion develops. Think of the period 1964-1984.

Unravellings see increasing distrust of the population towards the institutions. Individualism is growing stronger. In this cycle, this corresponds roughly to the period 1985-2007.

Crises lead to the destruction of the old order and the emergence of a new order during the peak of the next cycle/saeculum. We are in this phase! It started with the global financial crisis of 2008 and should be completed by the end of this decade…

This complex dynamic can be summarized as follows:

The Information Age is weakening nation states

The Sovereign Individual (1999) describes the advent of the Information Age as the most significant societal transition in centuries: the latest iteration of a series of mutations that have led humanity from the time immemorial of hunting and gathering to the agricultural and then the industrial era.

The authors, who rightly predicted the discovery of crypto currencies, foresee a reduction in the returns to violence during this new era. Nation-state will be increasingly challenged by new sovereignties capable of effectively providing protection while consuming much fewer resources.

The success of the nation state was based on its superior ability to extract wealth from its citizens and mobilize resources for large-scale warfare. The rise of cyberspace as a new economic domain will make assets easier to protect and harder to extort. This is the promise Bitcoin brings: that of a permission-less, censorship resistant, unconfiscatable money!

Inflationary money vs. deflationary technology

The Price of Tomorrow (2022) by Jeff Booth allows us to assemble another piece of the puzzle: it highlights the growing tension between the exponential deflationary force of technological progress in the digital age (the price of goods and services are dropping thanks to the efficiency gains produced by technology) and the headlong rush of inflationary policies inflating the money supply to counter it. The system will soon explode and will have to be replaced.

- Continue to print money at an accelerated rate in a Weimar Republic-like scenario that would wipe out citizens' savings?

- To cash in on a deflationary crash leading to the collapse of the banking system and bringing consumption to a sudden halt?

Bitcoin represents a bridge over the crises associated with the first two scenarios. In the first case, Bitcoin's extreme hardness acts as a protection against inflation. In the second, Bitcoin becomes the foundation of a distinct, completely separate but fully functional global monetary system.

The onset of a new age of money

Kondratiev (K) cycles – Soviet economist, Kondratiev demonstrated that the growth of capitalist economies cyclically combines a phase of sustained long-term growth followed by a period of depression. The cycles that bear his name last 40-60 years and are the result of a radical innovation or an industrial revolution that leads to a virtuous cycle of investment.

Goorha and Edstrom analyze the evolution of Bitcoin in light of these cycles by focusing on the evolution of the currency's hardness. They identify four K-cycles:

- the age of gold money (1873-1914)

- the age of the gold standard (1925-1973)

- the age of fiat money (1973-2009), and

- the age of Bitcoin (since 2009)

The depoliticiZation of Money

State control of money

To overcome the limitations of barter, man has sought a single common medium to transact: the currency, which is generally the most exchangeable good in a society. Primitive currencies included arrowheads, foodstuffs, shells... but monetary metals eventually imposed themselves and societies progressively converged towards gold.

In the past, the free market guided this process of selecting the best monetary asset. The selection of a currency is now a top-down process, a decision imposed on us by our governments.

Thousands of years of experimentation have thus led to select gold as the monetary asset of reference. It is an apolitical currency chosen by men. The politicization of money took place gradually. Many pretexts have been used to justify this seizure of power over a good that had until then depended essentially on the private sphere:

- By putting an end to private money, the government was going to protect the people from financial crises;

- By controlling money, the state would strengthen the national bond;

- By doing so, it guaranteed the monetary sovereignty of the nation.

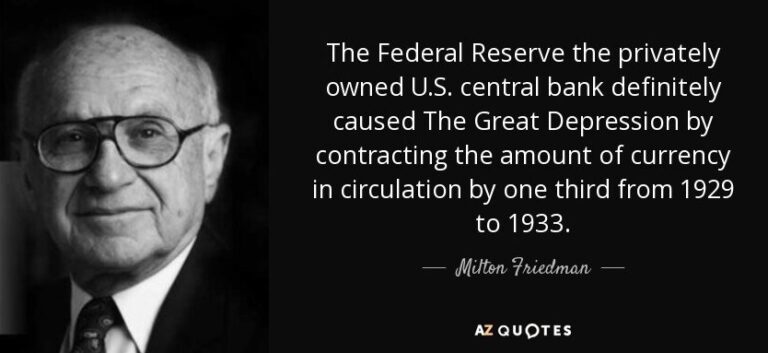

The control of money gave the state the means to finance its expensive policies and long wars. Today, real or imaginary crises justify frantic money printing. Central banks claim that their new role is to save the planet and are preparing to inject astronomical amounts of money into the economy (diluting citizens' savings in the process) to counter an ever more imminent climate peril.

The growing interference of state in money blurs the natural price-setting mechanism. Since prices are the main signal guiding investment, the whole market economy is disrupted.

Moreover, the power of money is accompanied by the state control of society, down to the smallest corner of our private sphere. Whether on the political, economic or cultural level, the politicization of money seems to precipitate a civilizational regression.

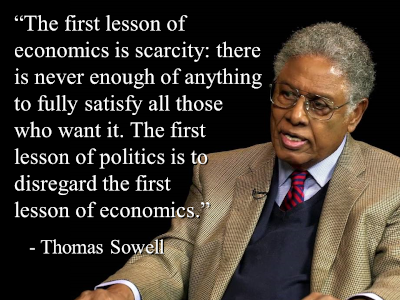

Bitcoin embodies a vision of money already championed by generations of thinkers, philosophers and economists since the Renaissance. The urgency for such a currency was well explained by some world-class economists such as Milton Friedman, Friedrich Hayek and Murray Rothbard.