An economy ever more dependent on debt

An economy ever more dependent on debt

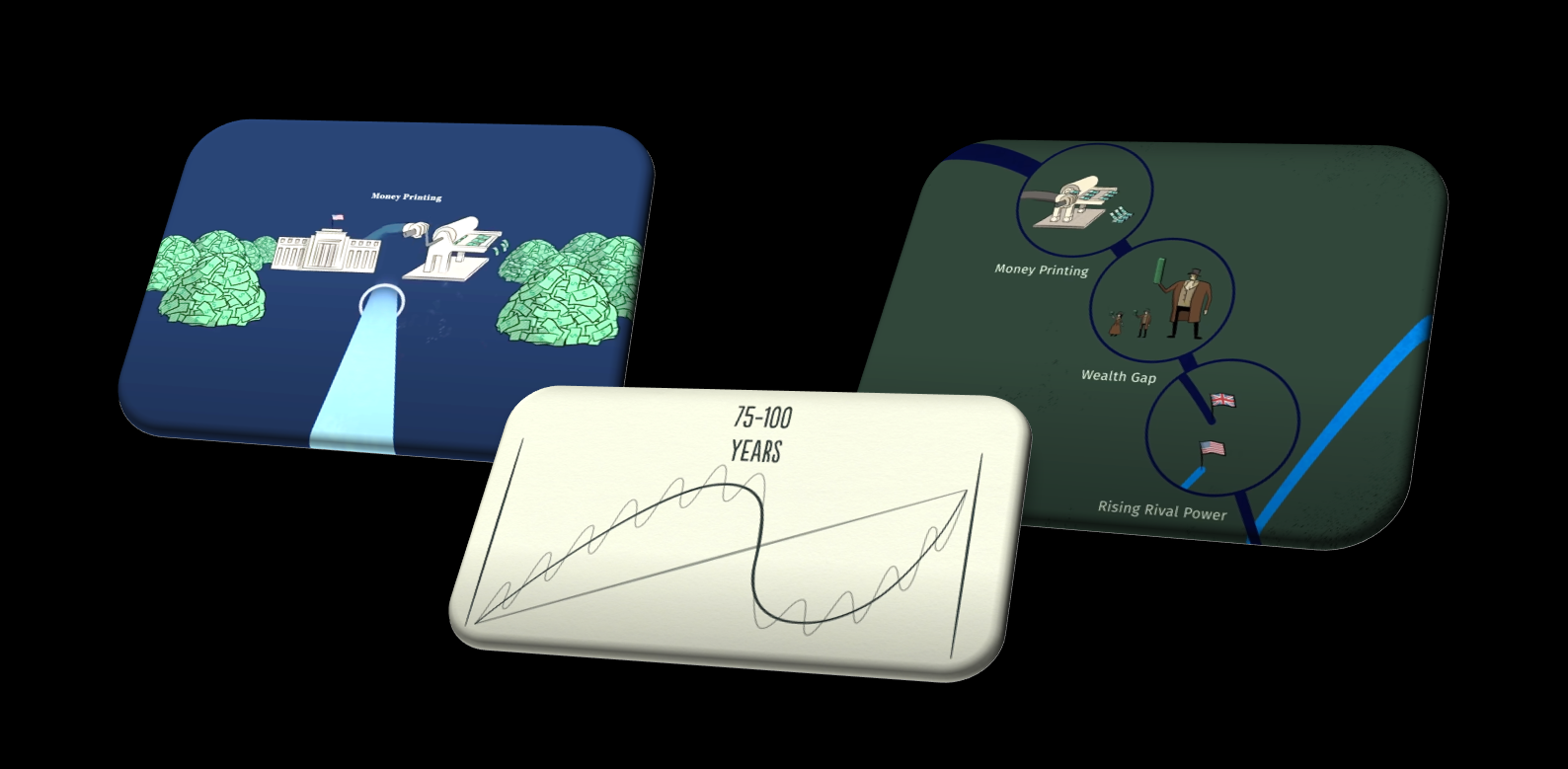

The mechanics of the economic machine in 30 minutes - Ray Dalio

An excellent introductory video to economics, which has the merit of emphasizing the growing importance of credit, of debt, in the functioning of our “economic machine”. It effectively illustrates the shortcomings of our economy where the manipulation of interest rates and the money supply inevitably leads to the reproduction of cycles of great violence for society.

Raymond Thomas Dalio (born August 8, 1949) is an American billionaire investor and hedge fund manager. Since 1985, he has co-managed the investments of the world’s largest hedge fund, Bridgewater Associates.

Unsustainable debt level

In The Changing World Order, Ray Dalio presents the results of an extensive analysis of the major economic and political cycles that have prevailed throughout history. The study focuses in part on the evolution of debt levels.

Dalio sees the COVID pandemic as the trigger for a global economic recession on a scale greater than anything we have seen in 80 years. A crisis widely expected in the final stage of the long debt cycle we are in. The debt levels of corporations (now referred to as zombie corporations, including in the mainstream media) and nation states have become unsustainable and central banks have no room to manoeuvre to postpone the inevitable.

When debt cycles break out, central banks devalue currencies by printing new money, as we are witnessing these days. The massive increase in the money supply causes disruptions throughout the economy, and tends to precipitate the collapse of reserve currencies (the end of the US dollar hegemony) and the emergence of a new monetary and financial order.

Towards a New World Order

Towards a New World Order

The end of a long cycle of indebtedness sees the emergence of a new monetary and financial order. As we are now in the final phase of such a cycle, we can guess that the new order will also be geopolitical. Power relations have changed considerably since 1945 and the hegemony of the dollar – the exorbitant privilege it grants to the USA – is increasingly being challenged.

Principles for Dealing with the Changing World Order - Ray Dalio

In this other excellent video, Ray Dalio shares the key concepts outlined in his book The Changing World Order: “The world is changing in a major way that has never happened in our lifetime, but has happened many times in history.”

Raymond Thomas Dalio (born August 8, 1949) is an American billionaire investor and hedge fund manager. Since 1985, he has co-managed the investments of the world’s largest hedge fund, Bridgewater Associates.

economic cycles - the austrian perspective

economic cycles - the austrian perspective

Economic Depressions: Their causes and cures, Murray Rothbard

Economic cycles are characterised by boom and bust phases, which are mainly caused by state intervention in the economy in the monetary, banking and financial fields. The credit glut and the manipulation of interest rates form an explosive cocktail that undermines the optimal allocation of capital, leads to malinvestment and prepares the inevitable recessionary phase that must follow.