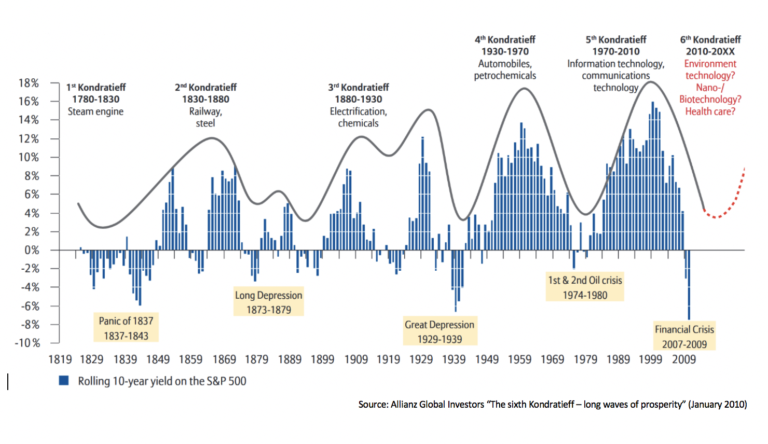

The remarkable irruption of Bitcoin deserves to be analysed through the prism of Kondratiev’s technological innovation cycles. The technological breakthrough represented by Nakamoto’s discovery unleashes a major potential for innovation in finance and in the economy as a whole, the extent of which is difficult to estimate at present. It can be assumed that Bitcoin will make a significant contribution to the next growth cycle.

Bitcoin’s meteoric rise follows the exponential growth characteristic of new technologies. The terminology is becoming more and more familiar, but the realities it describes are still largely unknown.

Kondratiev Cycles

Kondratiev Cycles

Kondratiev cycles – Soviet economist, Kondratiev demonstrated that the growth of capitalist economies cyclically combines a phase of sustained long-term growth followed by a period of depression. The cycles that bear his name last 40-60 years and are the result of a radical innovation or industrial revolution that leads to a virtuous cycle of investment. Bitcoin constitutes such an innovation.

Goorha and Edstrom analyse the evolution of bitcoin in the light of these cycles by focusing on the evolution of the currency's hardness. They identify four Kondratiev cycles:

- the age of gold money (1873-1914)

- the age of the gold standard (1925-1973)

- the age of fiat money (1973-2009), and

- the bitcoin age (since 2009)

According to this analysis, we can envisage the following stages for Bitcoin: the undisputed global reserve currency at the end of the first cycle, the basis of a global digital infrastructure in the second, and why not the basic protocol for interplanetary transactions in the third cycle!

exponential growth

exponential growth

In an increasing number of sectors, technological advances and their speed of adoption tend to grow exponentially.

While some technologies progress in small incremental steps, others progress at an incredibly fast pace. This is often the case with new technologies whose growth is said to be exponential.

In an incremental scenario, the performance of the technology may grow by 20% or 50% per year and you may, for example, go from 100 customers in one year to 150 the following year and 250 the year after that. In the case of exponential growth, the increase in performance is such that it takes you to orders of magnitude higher (x10, x100) as is the level of adoption which may go from 100 users in one year, to 1000 users the following year, and then to 100,000 users the following year.

Exponential Performance

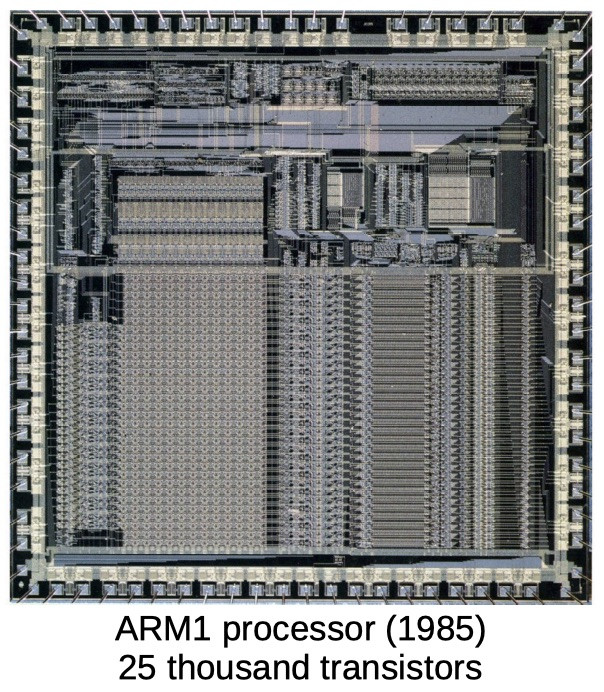

Moore’s Law predicts a doubling of the number of transistors on a microchip every two years and a halving of the cost of computers over the same period.

Exponential Adoption

Gains in connectivity, the rise of social media, the development of instant communications, and increased productivity in both manufacturing and delivery systems are driving waves of adoption of new products and services much faster and more powerfully than ever before.

The following superb interactive graphical tool allows you to compare the evolution of the adoption rate for various technologies over more than a century. Note the characteristic S-shape of the adoption curves.

The following graph highlights the acceleration of these exponential adoption phenomena. While it took 22 years to gather 50 million viewers, it took Twitter only 2 years to gather such an audience and 19 days for Pokémon go to attract 50 million players.

The world evolves at an accelerating pace

Time needed to reach 50M users

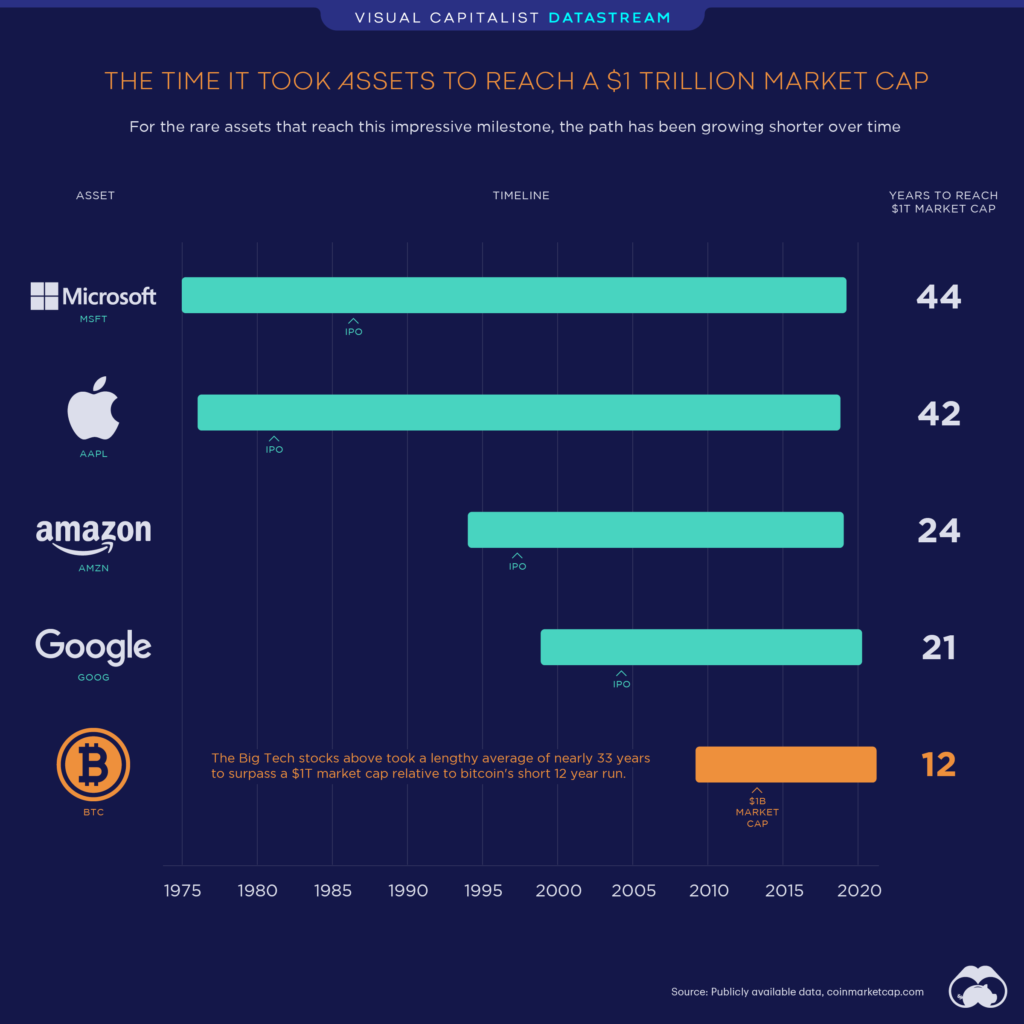

Bitcoin : the faster asset to reach 1 Trillion USD

Historically, companies generally needed several decades to reach a value of $1 trillion. Bitcoin only needed 12 short years to surpass this threshold. Step back here and take a look at how long it took the largest US technology companies to reach such a market capitalisation.

Beyond our capacity to comprehend

It is difficult for us to appreciate the magnitude of exponential phenomena because our minds are not used to recognising them. This is what the video below teaches us. The powerful technological transformation taking place in society is beyond our comprehension, yet it is happening before our eyes at a phenomenal speed.

Rate of change, AI : reflections of sci-fi master

“Society is always changing, but its rate of change has only been accelerating […] in part because change is cumulative […] It is when the industrial revolution came into being that this rate of change became so rapid that it was visible to the population within a single lifetime. People realised that not only are things changing but that they will continue to do so after their death… And it was at this time that Science Fiction emerged as a literary genre. – Isaac Asimov

“For the first time, we will be free, humanity will be free” – Isaac Asimov, last interview.

H/T B. Roemmele

A monetary system incompatible with technological progress

A monetary system incompatible with technological progress

But where have all our productivity gains gone?

In the natural order of things, the gigantic productivity gains resulting from our uninterrupted technological progress should make life easier, free up our time and allow us to acquire goods and services at lower cost.

But governments, indebted as never before in history, fear such deflation like the plague. It would greatly affect their ability to repay their debts and put an end to their increasingly expensive lifestyle. The monetary policies defined by the central banks thus guarantee them a level of inflation that allows them to continue to incur endless debt on the backs of citizens whose purchasing power and savings capacity are squandered. A permanent, silent hold-up.

The Price of Tomorrow is a warning of two trends: 1) technological progress and the price deflation it brings will lead to widespread and sustained unemployment; 2) the global economy is supported by an unstable mountain of debt. Jeff Booth is a successful technologist and entrepreneur in the e-commerce industry, a sector he has been able to follow closely for over 20 years. His experience puts him in an ideal position to decipher what happens when the inflationary monetary system collides with the rise of deflationary technologies.

Companies of all sizes are increasing their technology intensity to boost their productivity and profitability. Technology in general is a force that lowers prices and therefore makes us richer. This deflationary effect of technology, which is exponential in the digital age (network effects, AI), outweighs monetary inflation, an opposite force that dilutes our savings, the value of our time, and drives up prices. Inflation is a form of institutionalized theft. Yet central banks are mandated to maintain a certain level of inflation ostensibly to stimulate the economy but also clearly to facilitate the repayment of debt, its drug. Booth notes that the battle to control inflation is a losing one when it comes to technology products and services. It simply shifts inflation unevenly to other sectors of the economy.

Booth observes that our economic systems were designed for a pre-technological era when labour and capital were inextricably linked, an era that relied on growth and inflation. Indeed, most of today’s jobs are still largely wasteful and inefficient, which technological progress will eventually eliminate. The only real engine of growth today is the easy credit created at a staggering rate and the debt it induces that we can never repay. USD 185 trillion of debt was needed in the last twenty years (pre-COVID) to produce only USD 46 trillion of GDP growth. The growth rate would probably have been negative without all this stimulus.

More on Kondratiev Cycles

More on Kondratiev Cycles

Cycle Caracteristics

The Kondratiev cycles were first identified during the Russian communist era by the economist and sociologist Nikolai D. Kondratiev. He studied the long-term cyclicality of price variations of agricultural products and copper. He demonstrated the decisive influence of technological innovations and periods of change on these cycles.

Kondratiev cycles last 40-60 years. They are the result of a radical innovation or an industrial revolution that leads to a chain of investments in a virtuous circle.

Each Kondratiev cycle consists of an ascending A phase and a descending B phase. Phase A, which is the beginning of the cycle, is characterised by the introduction of innovations and the gradual revival of investment by companies anxious to remain competitive. Prices rise as do interest rates due to increased demand for borrowing. This phase A lasts about 20 years.

This is followed by a period of primary recession lasting about 10 years, which begins a 20-year depression (phase B) marked by economic stagnation and falling prices caused by supply outstripping demand. Interest rates fall in turn, as do consumption and investment. The result is a fall in the demand for money. The economic system is purged and the conditions for a new cycle are restored.

Quel avenir pour Bitcoin ?

Prateek Goorha and Andrew Enstrom’s analysis of Bitcoin’s evolution in light of Kondratiev (K) cycles focuses on the evolution of the hardness of money (money is a technology; its hardness is determined by the level of difficulty required to produce new units).

The authors identify four K cycles: 1) the age of gold money (1873-1914); 2) the age of the gold standard (1925-1973); 3) the age of fiat money (1973-2009); and the age of Bitcoin (2009 onwards). If we stick to 40-year cycles, Bitcoin should undergo some very interesting transformations before the last bitcoin is mined.

At the end of the first cycle, around 2047, 10 halving cycles (halving the reward amount associated with each block on the Bitcoin network) will have taken place and 99.90% of all Bitcoins will have been mined. The value of the block space will increase exponentially during this cycle. Bitcoin’s second K-cycle will rely on a series of associated technologies (embryonic or unimaginable at this stage) that will bring about the next transformation

Goorha and Edstrom note that Marc Andreessen’s famous comment “software is eating the world” is relevant to Bitcoin in the current cycle. Indeed, “Bitcoin is eating the monetary systems”. In its second K-cycle, Bitcoin will be associated with a much wider range of technologies, so we can probably say that “Bitcoin is eating digital economies” en masse. All this may still seem rather speculative today. That said, judging by the K-cycles since the industrial revolution, we can expect each K-cycle of Bitcoin to bring its share of absolutely transformational innovations for society on a global scale.

Bitcoin may be the undisputed global reserve currency by the end of the 1st cycle, may become the basis of a global digital infrastructure in the second, and may become the basic protocol for interplanetary transactions in the 3rd cycle!

Source:

The Schumpeterian Bitcoin Cycle, Prateek Goorha and Andrew Edstrom (2021)